Adoption of Newly-Approved 1L mNSCLC Regimens Driven by Promotional Activities

Promotion plays a major role in the successful launch of a new pharmaceutical product. Companies must develop a marketing strategy that effectively communicates the benefits of the therapy and differentiates it from competitors. The promotional strategy then is executed through a combination of channels including sales representative detailing, digital awareness, and other non-personal engagement tactics.

InCrowd’s newest Essentials research highlights the importance of promotion surrounding the launch of a new product with insights focused on the Non-Small Cell Lung Cancer (NSCLC) market.

In Nov 2022, two treatment regimens received FDA approval for use in 1L metastatic Non-Small Cell Lung Cancer (mNSCLC):

- Regeneron’s LIBTAYO + chemo (Nov 8)

- AstraZeneca’s IMFINZI + IMJUDO + chemo (Nov 11)

InCrowd’s Essentials syndicated market tracker monitored the awareness, perceptions, and adoption of these regimens throughout the first quarter of 2023.

The research revealed the following key findings:

- Adoption of the newly-approved regimens was modest in Q1 2023. LIBTAYO + chemo captured 2% of 1L mNSCLC PD-L1 prescribing. IMFINZI + IMJUDO + chemo captured 3% of the market. Less than one-quarter of oncologists reported prescribing either regimen.

- Promotional campaigns were very focused on a subset of prescribers. Both Regeneron and AstraZeneca executed focused promotional campaigns in Q1 2023, reaching less than half of relevant oncologists across a combination of channels, rep delivered and digital.

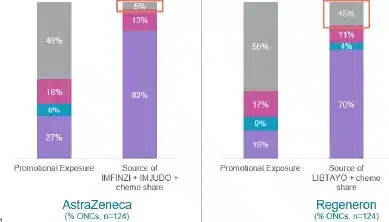

- Promotional activities played a major role in oncologist adoption of the newly-approved regimens. Eighty-five percent of LIBTAYO + chemo patient share and 95% of IMFINZI + IMJUDO + chemo patient share, came from the less than 50% of oncologists who received promotions from the respective manufacturers. This skew is not observed for established players in the market.

- Healthcare professionals (HCPs) receiving a combination of rep and digital promotions reported higher prescribing than those receiving only rep, only digital, or none. Seventy percent of LIBTAYO + chemo patient share came from the 18% of oncologists who received both rep and digital promotions in the past month. Eighty-two percent of IMFINZI + IMJUDO + chemo patient share came from the 27% of oncologists who received both rep and digital promotions in the past month.

To learn more about Essentials, contact us.

The post 2023 Q1 – NSCLC Essentials Readout appeared first on InCrowd.